If you’ve been following financial news, you might have heard about the Federal Reserve’s decisions to adjust the prime rate. Many homeowners and prospective buyers wonder why mortgage rates don’t change immediately or even directly in response to these shifts. Let’s break down the relationship between mortgage rates and the prime rate to clarify why they operate independently.

What is the Prime Rate?

The prime rate is the interest rate that commercial banks charge their most creditworthy customers, typically large corporations. It’s heavily influenced by the Federal Reserve’s monetary policy and serves as a benchmark for various loans, including personal loans and credit cards. When the Fed lowers the prime rate, it aims to stimulate economic activity by making borrowing cheaper.

The Mortgage Rate Landscape

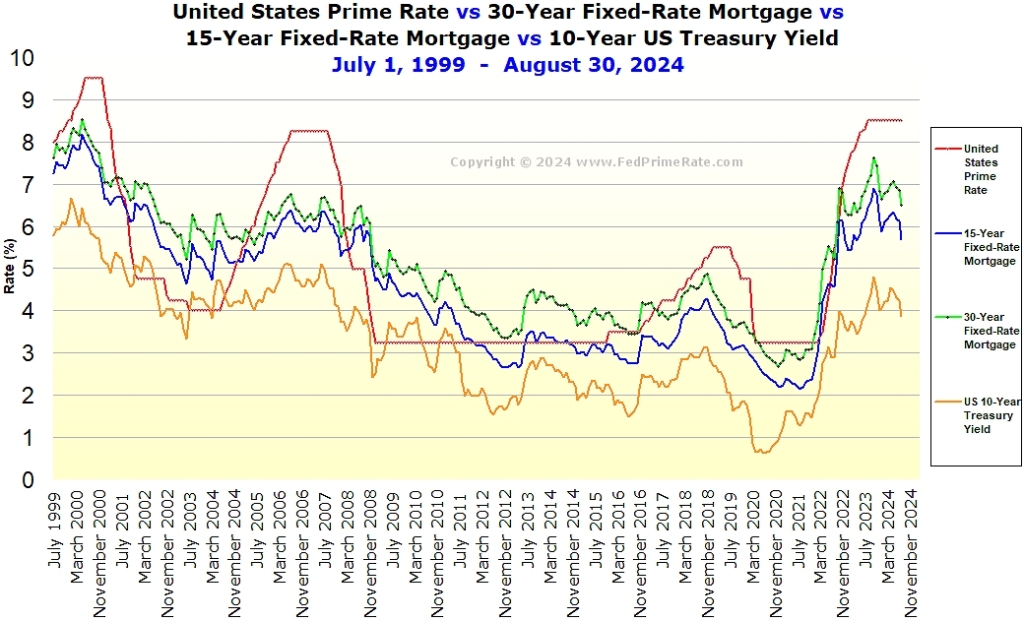

Mortgage rates, on the other hand, are influenced by a different set of factors. They are determined primarily by the bond market, particularly the yield on 10-year U.S. Treasury bonds. Here’s how the connection works:

Market Dynamics: Mortgage lenders use the bond market to set rates. When investors buy more bonds, yields drop, leading to lower mortgage rates. Conversely, if investors sell bonds, yields rise, pushing mortgage rates up. This means that mortgage rates are more reactive to market sentiment and investor behavior than to the prime rate.

Long-Term vs. Short-Term: The prime rate typically reflects short-term borrowing costs, while mortgage rates are more closely tied to long-term economic forecasts. Because mortgages are long-term loans (often 15-30 years), lenders consider long-term inflation expectations and economic growth when setting rates. Therefore, even if the Fed cuts the prime rate, it doesn’t guarantee an immediate drop in mortgage rates.

Risk Assessment: Mortgage lending involves assessing the risk of default over a longer period. Factors such as employment rates, housing market stability, and consumer confidence also play significant roles in how lenders determine mortgage rates. A stable or improving economy might lead lenders to lower rates, but if there’s uncertainty, they might keep rates high despite a decrease in the prime rate.

Operational Costs: Lenders have operational costs that they factor into mortgage rates. These costs can fluctuate independently of the prime rate, affecting how rates are set. If a lender anticipates increased costs due to regulatory changes or other factors, they might not pass on any potential savings from a lower prime rate.

Timing of Rate Changes

Another reason for the lag in mortgage rate adjustments is the time it takes for lenders to respond to changes in the prime rate. Lenders may need to analyze market conditions, gauge borrower demand, and adjust their strategies accordingly. This process can result in a delay between the Fed’s decision and changes in mortgage rates.

Conclusion

In summary, while the prime rate and mortgage rates are both influenced by the broader economic landscape, they are not directly tied to one another. Mortgage rates depend on market conditions, investor behavior, risk assessments, and the long-term outlook of the economy. As such, when the Federal Reserve changes the prime rate, it’s just one piece of a much larger puzzle that lenders must consider when setting mortgage rates.

For homeowners and potential buyers, it’s important to keep an eye on multiple economic indicators and not just the prime rate when navigating the mortgage landscape. Understanding these nuances can empower you to make informed decisions about home financing.